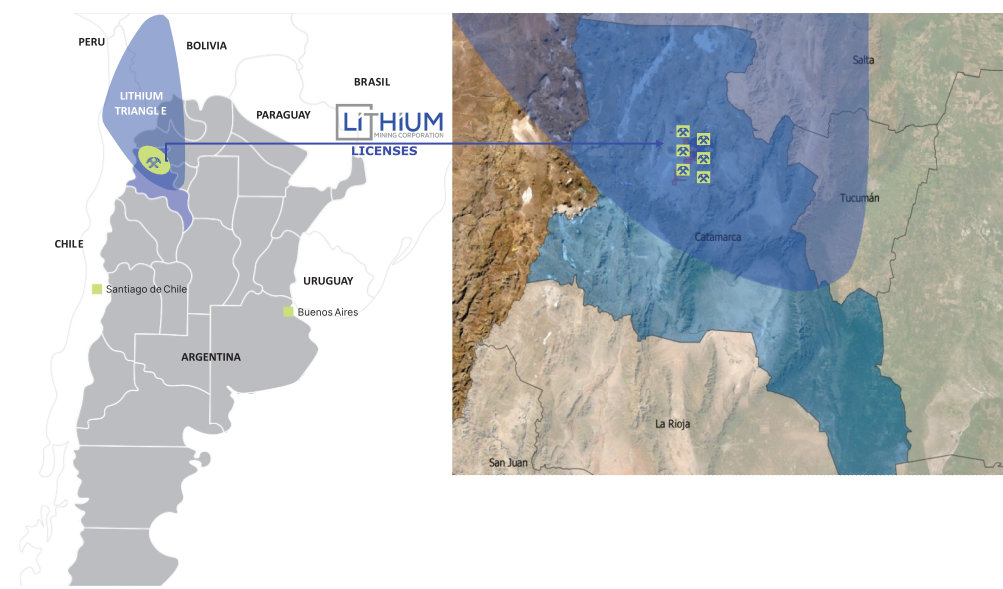

Location: Argentina

Lithium Situation

DEM intends to become one of the world leaders in the e-materials and e-mobility sector riding the wave of the electric mobility super-cycle that has just begun.

This cycle is being driven by a multitude of innovations in the aerospace, defense, health- care, automotive and consumer electronics sectors (battery-powered vehicles of all kinds, such as cars, trucks, drones, ships, trains, air- crafts, motorcycles, e-bikes, photovoltaics and energy storage systems). Suppliers, refiners and battery factories (also known as giga- factories) are being built on an unprecedented scale around the world, with no technology shift in sight.

On closer inspection, the required strategic and critical raw materials (e.g. lithium, cobalt, rare earths, manganese, copper and graphite) are nowhere near close to being available in sufficient quantities. This enormous shortage is already leading to distribution struggles between industrialized nations, and of course to significantly increasing prices and valuations of projects. The lack of these raw materials has significant consequences for a country’s economy and national security.

As an example, the European demand for Lithium (battery material) will increase by about 3500 – 4000 % by 2050. A similar development can be expected for rare earth elements (electric drives), especially since more than 60 % of the demand is already covered by China.

- Strong demand growth over the next 10 years for lithium with the increase in electric car sales

- Main global producers are Argentina, Australia, Chile and China

- DEM plans to consolidate one of the Top 10 lithium resources worldwide, through its Joint Venture LMC (Lithium Mining Corporation). LMC already holds a large portfolio of licenses (over 70,000 hectares) located within the Lithium Triangle of Argentina (Carachi Blanco-Project).